13777130213

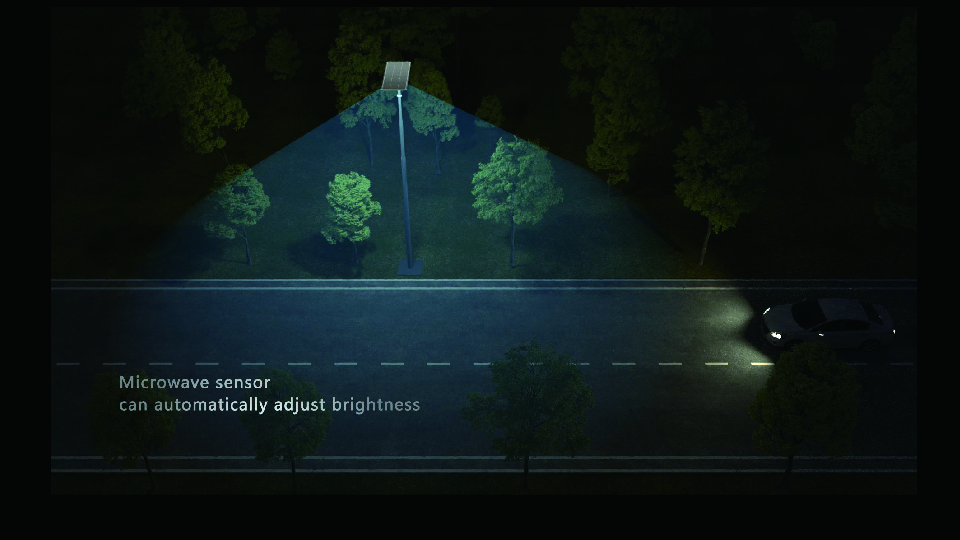

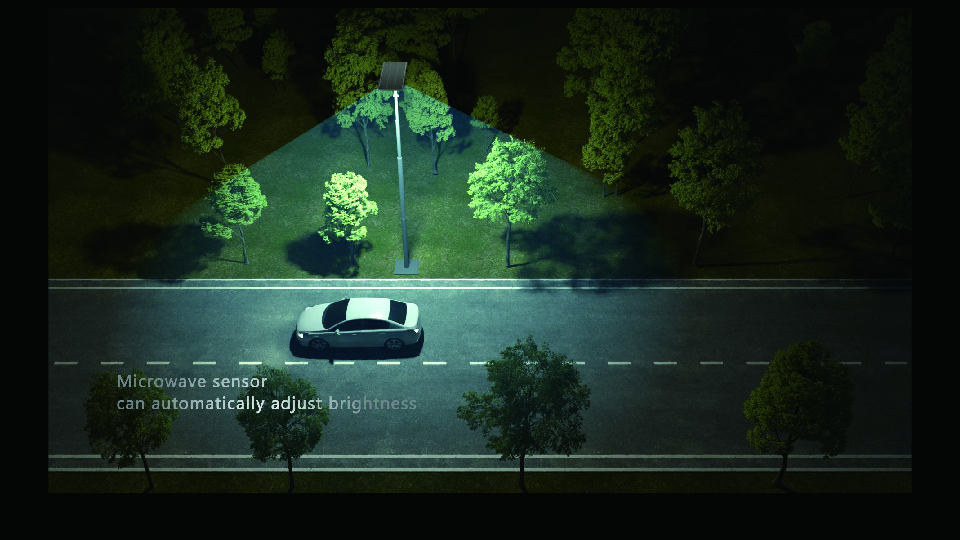

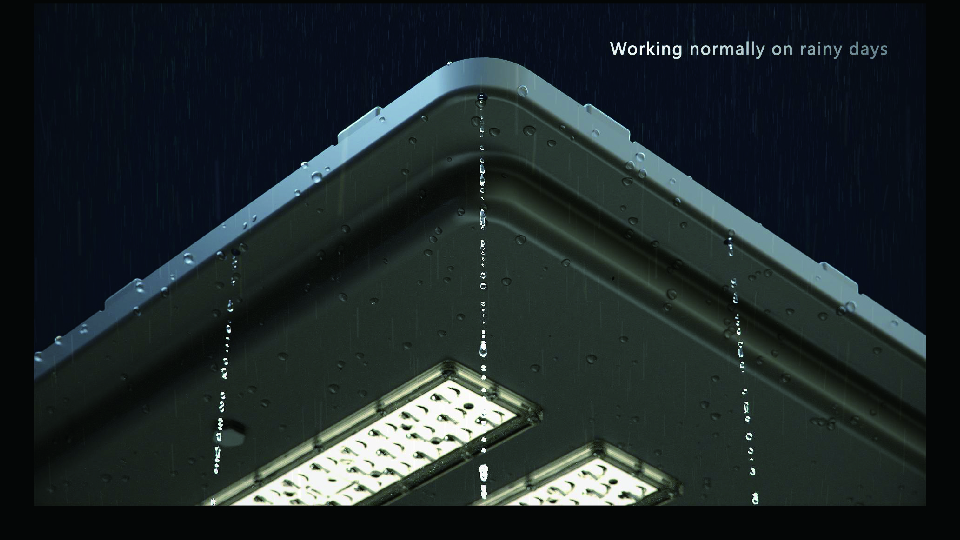

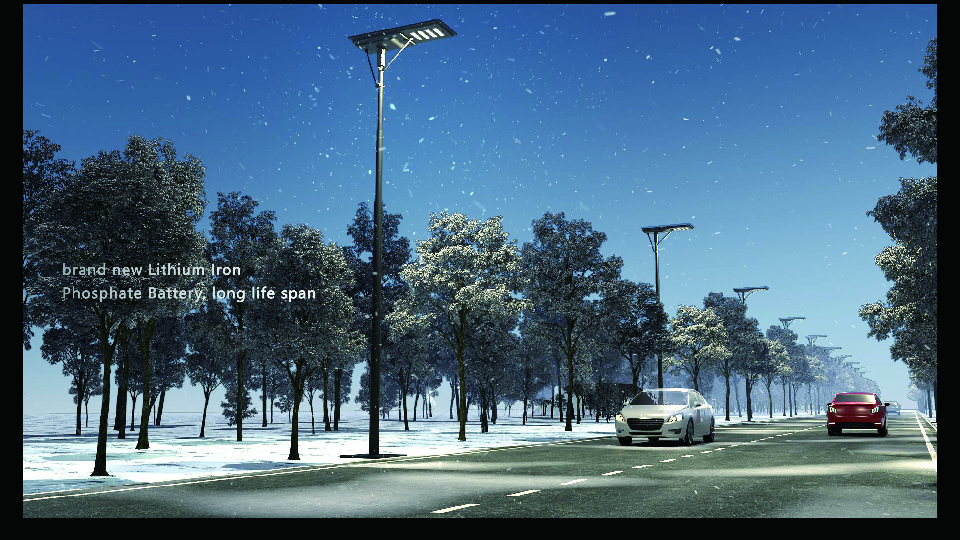

产品三维动画具有十分强的目的性,比如有产品宣传动画、产品安装动画、产品使用动画、产品原理动画等,它们无需通过情节来烘托画面的故事性,只需要对突出产品或者突出所需要表达的场景即可,因此一般的产品三维动画时长会在90秒到3分钟左右,专业点可以称为“最佳观看时间”,而镜头感和表现手法则是评判产品三维动画质量的主要因素。

通过动画分镜头你可以了解到三维动画

伴随计算机三维动画技术在工业领域中的发展和普及,工业三维动画逐渐成为受到企业青睐的新媒体营销的一种展示手段